About Dubai’s “D33” Economic Agenda to double GDP by 2033

Dubai Economic Agenda – D33, aiming to double the size of Dubai’s economy in the next decade and consolidate its position among the top three global cities

At the core of the Economic Agenda D33 is the launch of various innovative projects that promote sustainable economic growth. These projects are essential for enhancing Dubai’s global competitiveness. By implementing cutting-edge technologies and industry-leading practices, the agenda paves the way for significant advancements in sectors such as tourism, finance, and technology.

Foreign direct investment (FDI) plays a crucial role to achieve “D33” aspiration

Foreign Direct Investment (FDI) is a critical driver in realizing Dubai’s D33 Economic Agenda, which seeks to double the city’s economy by 2033. FDI contributes by bolstering economic growth across priority sectors such as technology, logistics, tourism, financial services, and real estate. It enhances job creation, promotes the transfer of knowledge and advanced technologies, and stimulates innovation, all of which are key components of the agenda’s sustainable growth vision.

Leading countries relying on FDI for their economic growth

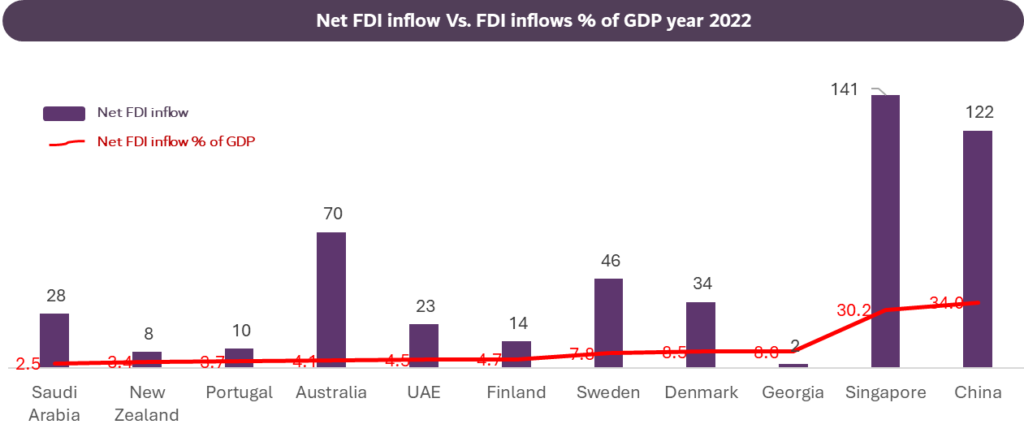

leading economies are catching up and boast not only strong FDI inflows and investor attraction, but also this plays a pivotal role in their GDPs and sustainable annual growth.

China and Singapore stand out with the highest net FDI inflows. Singapore’s FDI inflow as a percentage of GDP is notably high at 30.2%, reflecting its attractiveness as a global investment hub and its reliance on foreign investments to sustain economic growth.

Georgia presents an interesting case where, despite a lower absolute FDI inflow, its percentage relative to GDP is significant (34%), indicating a substantial reliance on external investments relative to its economic size.

Saudi Arabia, UAE, and Australia demonstrate considerable FDI inflows, yet their FDI percentages relative to GDP are lower, indicating these countries have more diversified and larger economies where FDI is one among many growth contributors.

Regulatory reforms has the most significant impact on countries

Some leading countries are actively working to reform their investment policies and create a more appealing environment to attract investors and affluent individuals

ClarixResearch outlines leading practices for attracting FDI and investors

These practices form a comprehensive approach to creating a dynamic and attractive environment for foreign direct investment and economic growth. For more detailed insights and tailored solutions, feel free to contact us.